Read the text from the article below. To read the PDF, click here.

Written by Eilidh Norman, Client Relationship Manager | Financial Planner

June 3, 2024

9-min read

What is a DA-1 and should I be using it?

This is not an uncommon tax query in Switzerland. The quick answer is:

It’s a form that can be filed with the Swiss tax return to claim back foreign (i.e. non-Swiss) withholding tax (WHT) on foreign dividend and interest income.

It is filed by Swiss tax resident individuals who have incurred withholding tax on their foreign (non-Swiss)) dividend or interest income.

As one might anticipate however, the full answer is a little more involved. If you are a Swiss tax resident with investment accounts anywhere in the world, this article will be relevant to you.

The following analysis aims to help explain how foreign source dividend and interest income should be declared on the Swiss tax return in order to reclaim foreign WHT and what else is required to ensure that the maximum withholding tax is being refunded. We are going to take the specific example of US source dividend and interest income for Swiss tax residents and how the related foreign WHT is claimed back.

The following analysis aims to help explain how foreign source dividend and interest income should be declared on the Swiss tax return in order to reclaim foreign WHT and what else is required to ensure that the maximum withholding tax is being refunded. We are going to take the specific example of US source dividend and interest income for Swiss tax residents and how the related foreign WHT is claimed back.

What is withholding tax?

Withholding tax is a tax automatically withheld at source by some countries on dividends and interest paid to non-residents of that country by companies incorporated within that country. It can be thought of as a way for a country to collect taxes on the dividends/interest that country pays to individuals who are not going to be filing a tax return there.

It’s a measure employed by governments to prevent tax evasion. Withheld at source by the “paying agent” (banker, broker etc.) and paid directly to the government, the aim is to incentivise taxpayers to declare this income for tax purposes in order to claim the refund of WHT.

Anybody with investments in foreign companies and investment funds is likely to have incurred foreign WHT. Failure to reclaim this WHT means that the individual has incurred double taxation on the income, once in the foreign country that has withheld the tax and again in the individual’s country of residence for tax purposes.

In addition, taking the specific example of US source dividend income received by a Swiss tax resident, if the income is paid via a Swiss broker/paying agent, even if the US WHT credit is claimed on the Swiss return, the claim may still not be complete (see Form R-US later).

There is a small plus side to the scenario however in that for a non-American, with no filing requirement in the US, US WHT means that there is no requirement to file an informational-only US tax return to declare this income in the US as the US has already received its piece of the pie. (Take the little wins where you can!).

What is Swiss withholding (or anticipated) tax (aka Verrechnungssteuer / Impôt anticipé)?

Let’s look at domestic WHT first. The Swiss Federal government levies WHT on Swiss source interest and dividend income at a rate of 35%. This income is usually declared in the bank and securities section of the Swiss tax return (the État des Titres (ET) in French/ Verzeichnis der Wertschriften und sonstigen Kapitalanlagen in Swiss German) as either “subjected” or “not subjected to withholding tax”.

Tax is calculated on total Swiss source income and a 35% tax credit imputed on the income that has already been subject to Swiss WHT. This WHT credit is deducted from the taxpayer’s final Cantonal, Communal and Federal tax liability thus eliminating double taxation.

How do US withholding tax and double tax treaties work for Americans in Switzerland?

To reduce the burden of double taxation internationally, many countries have entered into double tax agreements with each other. These agreements, or double tax treaties (DTT), set out how double taxation on different types of income should be treated in the respective jurisdictions, which jurisdiction has the right to tax it, to what extent and how relief may be provided.

A list of current treaty rates on interest and dividends per country can be found at https://www.fedlex.admin.ch/eli/cc/2020/29/fr

The US government requires tax to be automatically withheld at 30% on US source interest and dividends paid to non-US residents by companies incorporated within the US. (Note that non-US residents does not include American’s living abroad since Americans and green card holders are considered to be US resident for US tax purposes wherever they are in the world. The US does not levy US WHT on US residents).

The Swiss / US DTT (article 10 for dividends, 11 for interest) reduces US WHT for a Swiss tax resident to:

·0% on US interest income

i.e. there is no withholding on US interest income;

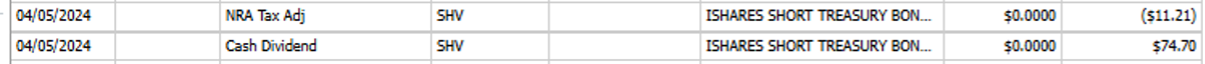

Please note that “interest” income from US bond ETFs like SHV, BND, VCSH, etc. are treated as dividends and therefore subject to 15% withholding. An example at Charles Schwab is below:

Interest from Schwab itself on cash withholding is indeed subject to 0%:

5% for qualified corporate participations in a US company paying dividends

A qualified participation is considered to exist when the company holds more than 10% of the shares of the company paying the dividend.15% in all other cases e.g. “normal” US dividends.

The DTT also provides that relief from double taxation may be provided under the treaty as a tax credit (treaty relief).

Do I Need to File a Form W8-BEN?

Without claiming the lower withholding tax treaty rate, 30% will be the default WHT rate applied by the paying agent on the US source dividend and interest income.

To allow the bank / broker (“paying agent”) to withhold WHT at the applicable treaty rate, the taxpayer must provide the paying agent with a signed W8-BEN (valid for 3 years). The paying agent is then authorised to pay out the US interest income gross (i.e. net of 0% WHT) and the US dividend income net of 15% WHT. Be aware when completing the W8-BEN, that certain custodians, such as Schwab, will not let you override a tax treaty rate on a Form W-8BEN and request you to leave the treaty rate blank for their internal compliance to handle.

Once the W8-BEN is in place some of the double taxation issues, from the Swiss perspective, are resolved. All that remains is for the taxpayer to claim treaty relief for the 15% US WHT remaining on the dividend income. This is done through the Swiss tax return filing using form DA-1.

What is a DA-1 Form?

The DA-1 is the official form filed with the Swiss tax return to claim a credit for foreign (i.e. non-Swiss) WHT. The minimum claim is CHF 100. It’s not an obligatory part of the filing so it is up to the taxpayer whether they want to claim the tax credit or not and to make sure that the form is filed if they do.

The total foreign tax credit claimed on the DA-1 flows into the bank and securities statement in the Swiss return and is credited against the taxpayer’s Cantonal, Communal and Federal tax liability. An example of the DA-1 is below:

The columns are completed as follows:

Once complete, the totals flow through to the ET and the foreign (US) WHT being claimed is credited against Cantonal, Communal and Federal tax due for the year i.e. CHF 205.65 of “non recuperable foreign tax” (treaty rate foreign WHT).

What is a Form R-US (164)?

There is one final step to consider for Swiss tax residents holding US securities which applies when the US securities are held through a Swiss broker.

As we have seen already, in the absence of a W8-BEN being filed, a Swiss broker will automatically apply US WHT at 30% of which only 15% can be reclaimed in Switzerland under the Swiss US DTT. The remaining 15% is either lost into the ether or needs to be claimed by filing a complex and expensive Form 1040-NR (non-resident alien individual tax return). A tax treaty stance would be taken on the return saying why the taxpayer is eligible for 15% and apply for the difference to be refunded. This will rarely (if ever) be worthwhile and should be avoided by ensuring proper withholding upfront. Filing this form invites unnecessary scrutiny and is prone to error particularly when done cheaply or via DIY software.

However, if the W8-BEN has been filed with a Swiss broker or the Swiss broker is a qualified Intermediary (QI), then WHT will still be withheld at 30% however, this is not the default 30% US WHT rate. It consists of:

15% US WHT (reclaimed using form DA-1)

plusa 15% supplementary Swiss withholding tax (25% for qualified corporate participations where the US WHT rate under the treaty is 5%)

This can be reclaimed using form R-US 164

Supplementary Swiss WHT (SWHT) (Retenue supplementaire d’impôt en Suisse (USA)/ Zusatzlicher Steuerruckbehalt in des Schweiz (USA)) is levied by Swiss QI’s on US source income for exactly the same reason as Swiss WHT is withheld on Swiss source income i.e. to avoid tax evasion by incentivising the individual to declare the income in Switzerland in order to recuperate the Swiss supplementary withholding tax. Without it, there may no longer be any incentive to declare the foreign income in the Swiss tax return.

SWHT is reclaimed using form R-US 164 (or on a combined DA-1 / R-US form depending on the canton) which is also filed with the Swiss tax return. This claim is specifically for taxpayers receiving US dividend income through a QI (or Swiss broker where a W8-BEN is in place) as the broker is obliged to make this additional 15% Swiss withholding on US source income.

The example R-US form below is laid out similarly to the DA-1. The entries in the final two right hand columns show the gross foreign source income on which SWHT has been withheld followed by the amount of SWHT being claimed back (see the yellow highlighted figures).

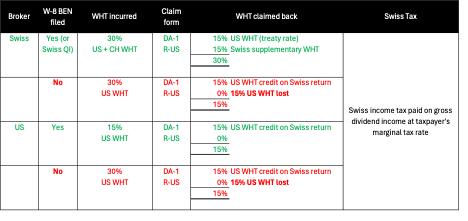

Should I file a DA-1? A Quick Summary.

The easiest way to summarise the above is using a table:

If you have US investments that issue interest or dividends:

file a W8-BEN (every 3 years) with your custodian (bank/broker).

file a DA-1 (annually) to claim the treaty foreign WHT credit.

if your broker is Swiss, ensure that you are also claiming the Swiss supplementary withholding tax refund using form R-US!

If you’re an American claiming foreign tax credits on what was withheld from your foreign dividends within your US ETF (from BNDX or VXUS, for example), please do not claim for that to be refunded via your Swiss return. It begins a circular foreign tax credit calculation which, barring some effort, can easily result in overestimating the foreign tax credit on your US return.

Last but not least, just be aware that the maximum amount of foreign WHT as a whole that can be claimed is limited to the total Swiss tax incurred on the same income (after deduction of any interest payable and acquisition expenses). (See article 8 to 11 of the Ordonnance du Conseil federal f 22 August 2067 on this subject).

At White Lighthouse Investment Management, we are both investment management and financial planning professionals. While we do not file tax returns on behalf of our clients, we maintain a close working relationship with many of our clients’ tax advisors and help our clients invest more efficiently. We strongly encourage our clients to maintain tax compliance in all jurisdictions they are required to, however we also encourage them not to pay any more tax than they legally have. If you are a client of White Lighthouse reading this and would like to discuss the implications for your situation, please reach out to us. If you are would like to inquire about working with White Lighthouse, please visit the Contact US page on our websites www.white-lighthouse.com (For US taxpayers resident anywhere in the world) or www.white-lighthouse.ch (for non-Americans in Switzerland).