Read the text from the article below. To read the PDF, click here.

Each year the IRS provides updated information related to the new tax year. Use this guide as a quick reference to the most common dates and tax provisions for American expats.

As a reminder, every American who meets the following worldwide income thresholds MUST file a US tax return:

Single: $12,950

Head of Household: $19,400

Married Filing Jointly: $25,900

Married Filing Separately: $5

Self-Employed: $400

You must file a Foreign Bank Account Report (FinCEN Report 114) if you hold the equivalent of $10,000 at any time, across foreign accounts.

2022 FILING DEADLINS FOR TAX YEAR 2021:

April 18th

US Tax Return deadline for US tax residents

FBAR Deadline – automatic extension available

June 15th

US Tax Return deadline for Americans abroad

October 17th

US Tax Return – extended deadline

FBAR – extended deadline

December 15th

Additional Expat extension

FOREIGN EARNED INCOME EXCLUSION (FEIE)

A tax benefit allowing expats to exclude some or all of their foreign income:

2021: $108,700

2022: $112,000

FOREIGN HOUSING EXCLUSION

Combined with the FEIE (above) and is based on your foreign location:

2021: See Section 3 for housing limitations

2022: Updated housing costs expected to be released around March 2022

FOREIGN TAX CREDIT

A nonrefundable tax credit for income taxes paid to a foreign government. You can optimize between using the Foreign Earned Income Exclusion and/or the Foreign Tax Credit to help reduce your US tax liability.

ESTATE & GIFTING

Annual Gift Tax Exclusion:

2021: $15,000 per person

2022: $16,000 per person

Annual Gift Tax Exclusion for gift to non-US citizen spouses:

2021: $159,000

2022: $164,000

*Gifts made between US citizen spouses are not taxable in any amount

Estate Tax Thresholds:

2021: $11,700,000

2022: $12,060,000

RETIREMENT CONTRIBUTIONS

Standard Deduction:

Married filing jointly

2021: $25,100

2022: $25,900

Single OR Married filing separately

2021: $12,550

2022: $12,950

Head of Household

2021: $18,800

2022: $19,400

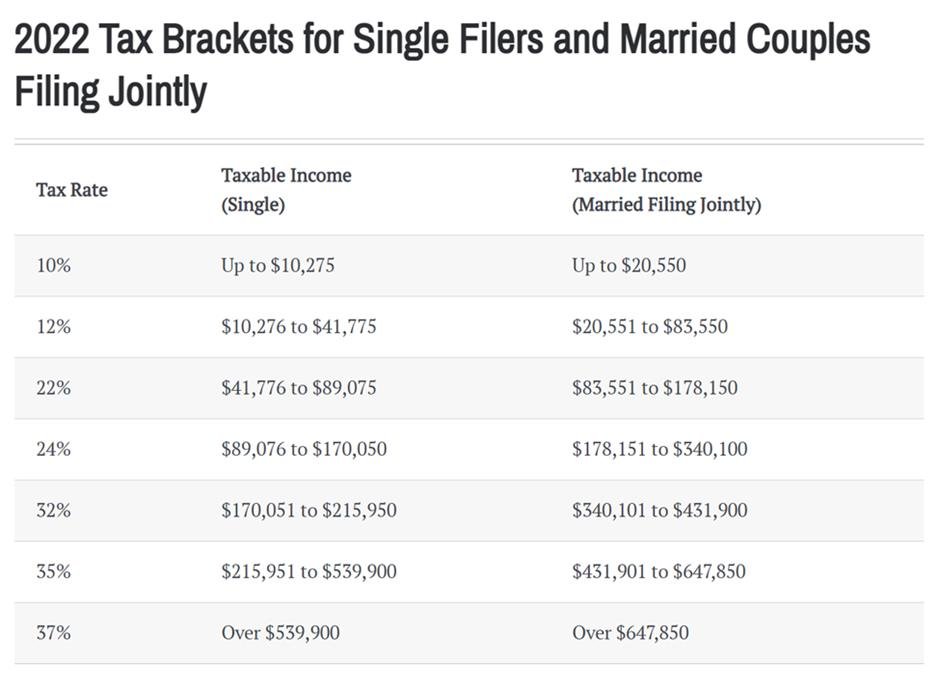

Marginal Tax Rates:

2022: Tax brackets have remained the same since 2018, the brackets are indexed annually to adjust for inflation. The top US bracket remains 37%.

GENERAL UPDATES

Contribution limit for employees who participate in 401(k), 403(b), and most 457 plans:

2021: $19,500 (or $26,500 if you are over 50)

2022: $20,500 (or $27,000 if you are over 50)

Traditional IRA, deductions available for employees/spouses who do not have access to a qualified US plan, regardless of income:

2021*: $6,000 (or $7,000 if you are over 50)

2022: $6,000 (or $7,000 if you are over age 50)

*2021 contributions can be made through April 15, 2022

Use this guide as a quick source for US figure changes, but please speak with your tax advisor and/or financial planner to discuss planning around your unique situation. Some of my favorite planning opportunities for Americans in Switzerland include:

Deductible Traditional IRA contribution – available regardless of income, when your employer does not offer a US qualified retirement plan

Spousal gifting from a US citizen to a non-US citizen spouse

Head of Household filing status for US citizens who are married to a non-US citizen spouse and have a qualifying dependent child

Swiss treaty recognition of US qualified retirement accounts

Pillar 2 withdrawal when departing Switzerland

If you have any questions on tax changes for 2022 or some of the planning opportunities mentioned above, please do not hesitate to connect with me, Arielle Tucker CFP® & IRS Enrolled Agent. I work at White Lighthouse Investment Management, a fee-only Financial Planning firm that specializes in working with Americans living in Switzerland.